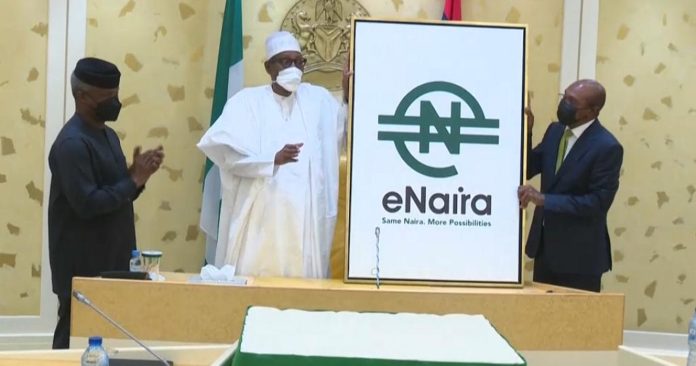

Eleven months after its lunch, Nigeria’s Central Bank Digital Currency (CBDC), the eNaira, has recorded ₦4 billion ($9.3 million ) in transactions.

According to the Central Bank of Nigeria (CBN) governor, Godwin Emefiele, over 200,000 transactions valued at ₦4 billion have been made on the platform. The e-Naira app has reached 840,000 downloads, with about 270,000 active wallets comprising over 252,000 consumer wallets, and 17,000 merchant wallets.

But it’s not enough for Emefiele and the CBN. After completing the first [launch] phase of the CBDC, the Nigerian government plans to get 8 million active subscribers in a second implementation phase that includes launching USSD transactions.

Most digital currencies are unavailable to Africans because they require smartphones and internet access. Nigeria’s internet penetration rate is at 37.3% while less than 40 million have smartphones. This means over 100 million Nigerians are excluded from digital initiatives like the e-naira.

With USSD though, things will change. CBN plans to achieve its 8 million target by allowing more Nigerians—especially those without access to digitisation—to access the e-naira. Over the next couple of weeks, Nigerians can create, fund, and use e-naira wallets by dialling *997#.

While Nigeria is the first African country to launch CBDC, other African countries have plans in motion, and are using the CBN’s successes and failures as guidelines. Kenya, Madagascar, Eswatini, Rwanda, Ghana, Morocco, and Tunisia have already instituted plans to launch CBDCs, which are in various stages of development.

eCedi

Meanwhile, Ghana has gone very far with the piloting of its own CBDC, the eCedi, following the release of a design document, which created both an online and offline versions of the eCedi.

All three institutions participating in the eCedi pilot – Vodafone Ghana, Calbank and IT Consortium say the pilot has been very successful so far and they are confident of a quick adoption when eCedi goes public.

The Bank of Ghana has said it is adopting an indirect approach to the rollout of the eCedi, which means it will use the existing digital finance infrastructure belonging to the various entities in the space, so the eCedi users with remain the customers of those entities with the central banking only playing a regulatory role.

It has however stated that it will not take on the inefficiencies of the existing infrastructure because eCedi is designed to behave exactly like cash so any technical challenges that impacts its immediate availability will not to tolerated.