Ecobank Ghana has stamped its authority as a driver of financial literacy and inclusion, using its annual Ecobank Day to embark on an immersive and interactive financial literacy program for women and youth in small businesses located in deprived communities.

On this year’s Ecobank Day, under the theme: Financial Inclusion for All, Leave No One Behind, the bank engaged hundreds of mainly women and youth in small businesses from deprived communities at the University of Professional Studies (UPS), and trained them in bookkeeping, budgeting, basic accounting, saving culture and financial management.

The participants also benefitted from lessons on how to easily open bank accounts remotely on phone or at agent shops without visiting a branch, and how to easily receive and make payments, access loans, and to send funds to loved ones among other things using digital platforms.

Staff of all of Ecobank Group’s entities in Ghana, comprising of the bank, Pan-African Savings and Loans and of EDC, as well as finance experts from the university were on hand to take the participants through the various topics in a very interactive session.

The staff of the Group also assisted the participants to open accounts and also set up Ecobank Mobile Apps on their phones.

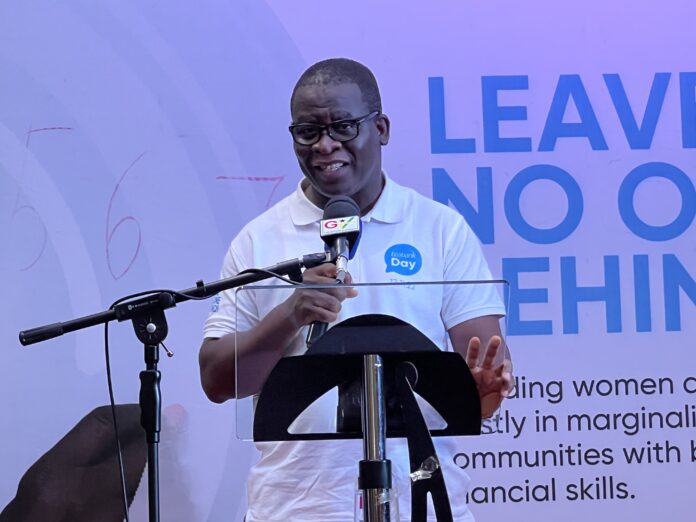

Managing Director of Ecobank Ghana, Dan Sackey noted that the bank chose to focus on financial literacy because available statistics show that some 68% of people living in Sub-Saharan Africa are still not financially literate, and that include even very educated people.

“The challenge at hand is enormous, as it is estimated that 68% of sub-Saharan Africans are not financially literate. That is almost seven out of every ten people. Also, 62% of the unbanked live in rural areas; 40% of the unbanked are young adults aged 15 to 24; and 74% of the unbanked have, at most, primary education” he stated.

Dan Sackey said, as part of Ecobank’s contribution to reducing those statistics, the Ecobank Group in Ghana held four simultaneous events on Ecobank Day in Accra, Kumasi, Takoradi and Tamale to provide as many people is small businesses as possible with financial literacy.

“There is one slated for Manya Krobo, which will be observed at a later date, due to unforeseen circumstances. Apart from Accra where participants are drawn from diverse backgrounds for today’s event, those in the other three centres are members of various Seamstresses associations, operating from deprived and marginalised communities,” he said.

According to him, Ecobank recognises that financial literacy and financial inclusion are life-changing matters, and that was why they treat them very seriously, adding that raising financial literacy, will in turn drive financial inclusion in local communities.

Dan Sackey said the intent is to help people improve their finances, recordkeeping, ability to successfully start and run businesses, and improve their quality of life.

In addition to training the women and youth in small businesses, Ecobank also presented some 50 sewing machines to the vulnerable ones identified in each of the locations where the participants were drawn from.

Dan Sackey expressed the hope that with the knowledge gained from the training, “the beneficiaries will put the machines to commercial use to be able to generate incomes to improve the lives of their families in order to gain financial independence.”

He also used the occasion to caution customers against fraudsters on the digital finance platforms saying that “customers should never give out any sensitive information relating to their bank accounts, debit or credit cards, OTP or PIN. It does not matter how convincing, professional, or genuine any callers may sound.”

He noted that currently, there is a message making the rounds on WhatsApp platforms about fraudsters using an Ecobank landline to call customers and defraud them, adding “Let me say emphatically that those numbers are not Ecobank numbers. The truecaller identification could be as a result of some victims who have saved those numbers as Ecobank lines, after receiving initial calls from the fraudsters.”

The MD urged all customers to always visit an Ecobank branch, when in doubt.

Meanwhile, all the lessons taught at the event will be compiled into a play by the Complementary Education Agency (CEA) of the Ghana Education Service, which will be recorded to be used as an educational material on financial literacy for various small trader and business groups across the country all year round.