MTN South Africa is venturing further into territory traditionally occupied by the country’s banks.

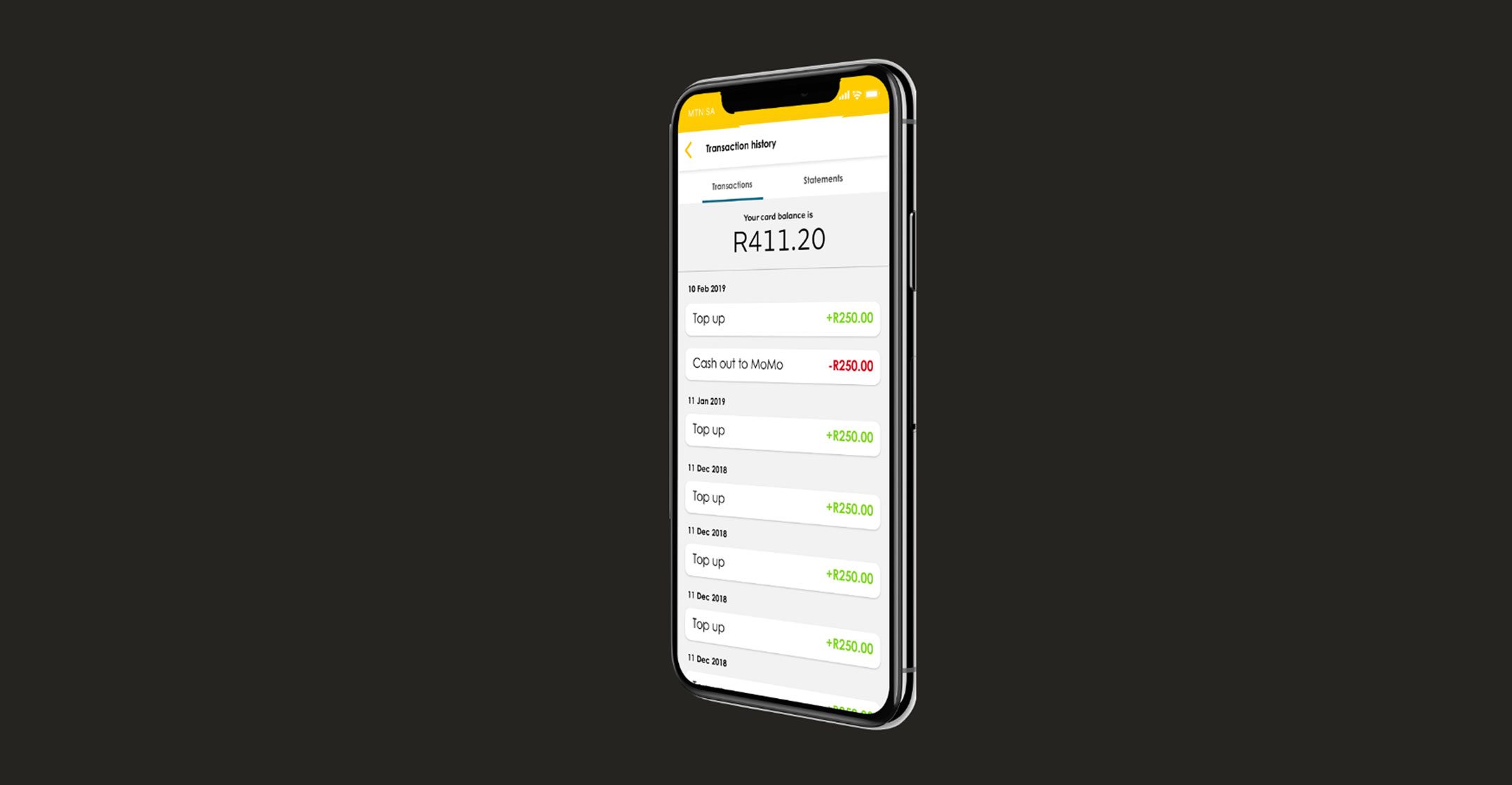

The telecommunications operator on Thursday added a raft of new features and services to its MoMo (mobile money) platform, and said it has built a “sophisticated” suite of financial products aimed at the underbanked and at digitising transactions that still take place using cash.

It announced the addition of international remittances and other new features at an event in Sandton.

“With international remittances, MoMo is breaking down barriers to international money transfers,” said MTN South African financial services head Bradwin Roper.

This allows both foreign nationals in South Africa and local residents to send money to MoMo users across 12 African countries, with zero data charges for MTN customers in those markets, said Roper.

The move expands the company’s mobile money focus to South Africa’s US$2-billion remittances market – $1.1-billion of outflows and $873-million of inflows in 2022, according to the World Bank’s Migration and Development Brief, released in June.

In line with Roper’s goal of enabling digital participation and financial inclusion by attempting to make sure a user’s “R100 stays R100”, MoMo has cut remittance costs significantly compared to average market fees.

MTN MoMo remittances

“With a 4% service fee, we charge half of what you would typically pay an incumbent [for the same service]. MoMo to MoMo transfers from South Africa to the continent (Africa) are completed in real time using a live selfie test for security and South African IDs or international passports for identity verification,” Roper said. He added that the remittances functionality will help MTN “capture the diaspora”.

MoMo has partnered with Reserve Bank-approved dealer Clicksendnow to enable remittances to Zambia, Ghana, Cameroon, Rwanda, Uganda, Ivory Coast, Liberia, Congo-Brazzaville, Benin, Guinea Conakry and Guinea Bissau.

MoMo’s suite of digital financial products – they include an Android-powered point-of-sale device for merchants, funeral cover aimed at gig workers and low-income earners, multi-channel cash-out facilities, and zero service fees on most transactions – are poised to challenge banks as they scramble for market share in lower market segments.

“At MTN, we are committed to offering an alternative to expensive banking services. We are achieving this by introducing value-added platforms to our services that offer device users cheaper, more accessible options,” Roper said.

“People, particularly in those in rural areas where traditional infrastructure is lacking, seek connectivity, simplicity, reliability and an increasing range of services from a single source.”

“People, particularly in those in rural areas where traditional infrastructure is lacking, seek connectivity, simplicity, reliability and an increasing range of services from a single source.”

Another of the new features launched by MTN is the MoMo Business Wallet, which allows businesses to receive payments directly from customers in real time without incurring transaction fees. “It opens the doors to the vast potential base of customers who are already embracing MoMo wallets,” it said.

MTN MoMo has nine million registered users in South Africa. MTN does not say how many of these users are active.